Elevate Your Trading Skills with Our Courses

Online learning is not the next big thing, it is now the greatest thing ever.

We Make Your Learning Through Awesome

At Stockbhart, we're passionate about empowering individuals to achieve financial freedom through the art and science of trading. Founded with a commitment to education and innovation, Stockbhart has become a trusted name in the online trading education space.

1

Get your knowledge boosted with our FREE courses.

2

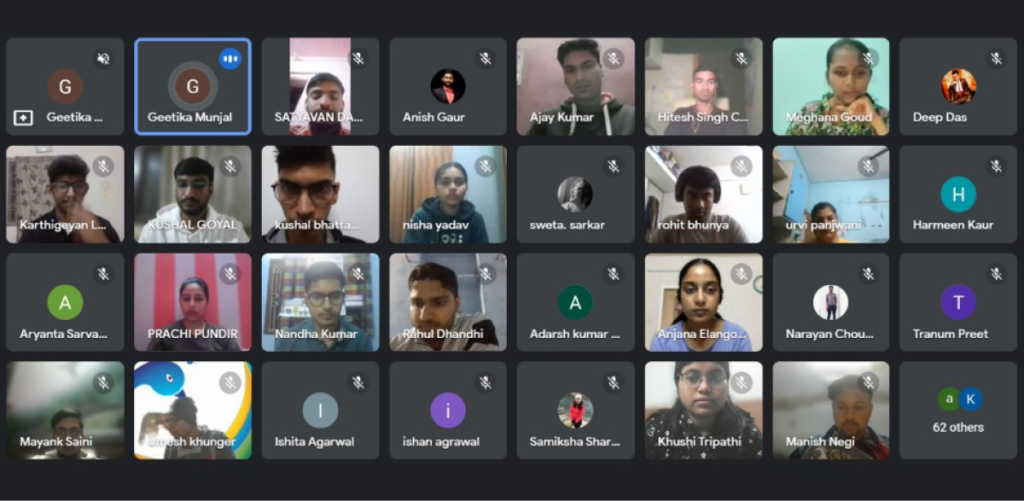

IWith 1000+ students we have done the best for everyone.

3

High level reach with 400+ teachers all around globe

Structured Learning Path

Study LFREE TRADING skills from top industry experts

Our courses are taught by experts in their respective fields. You'll have the opportunity to learn from experienced professionals who are passionate about sharing their knowledge with you.

Get Quality Education with Stockbhart school

Are you eager to expand your knowledge and skills, but concerned about the cost of education? Look no further! Stockbhart School is proud to offer a range of specialized free courses designed to empower individuals like you to learn, grow, and succeed. Our commitment to accessible education means that you can now access high-quality learning experiences without breaking the bank.

Most Popular Courses

Our courses are taught by experts in their respective fields. You'll have the opportunity to learn from experienced professionals who are passionate about sharing their knowledge with you.

FREE COURSE 1

15-20 SESSIONS. 3 DOUBT CLASSES

FREE COURSE 2

15-20 SESSIONS. 3 DOUBT CLASSES

FREE COURSE 2

15-20 SESSIONS. 3 DOUBT CLASSES

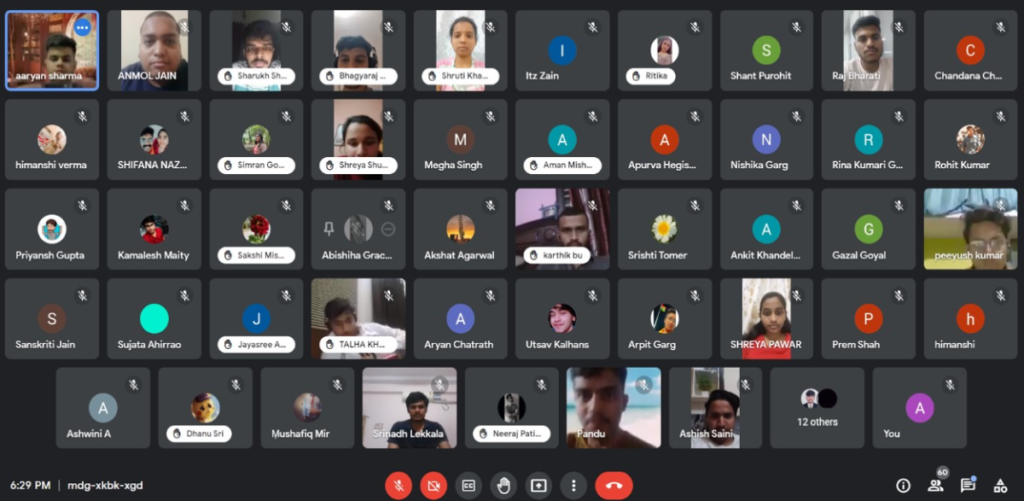

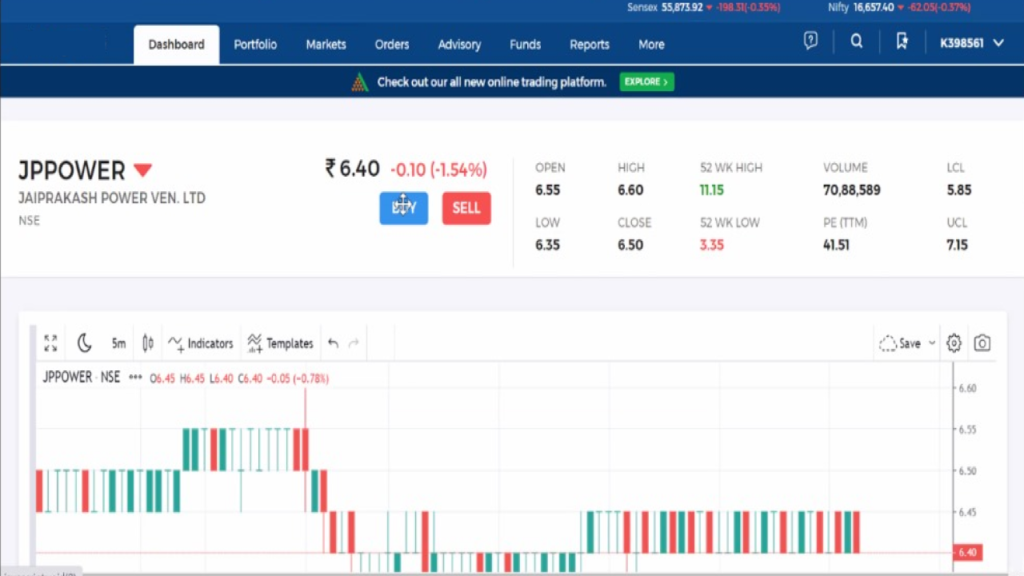

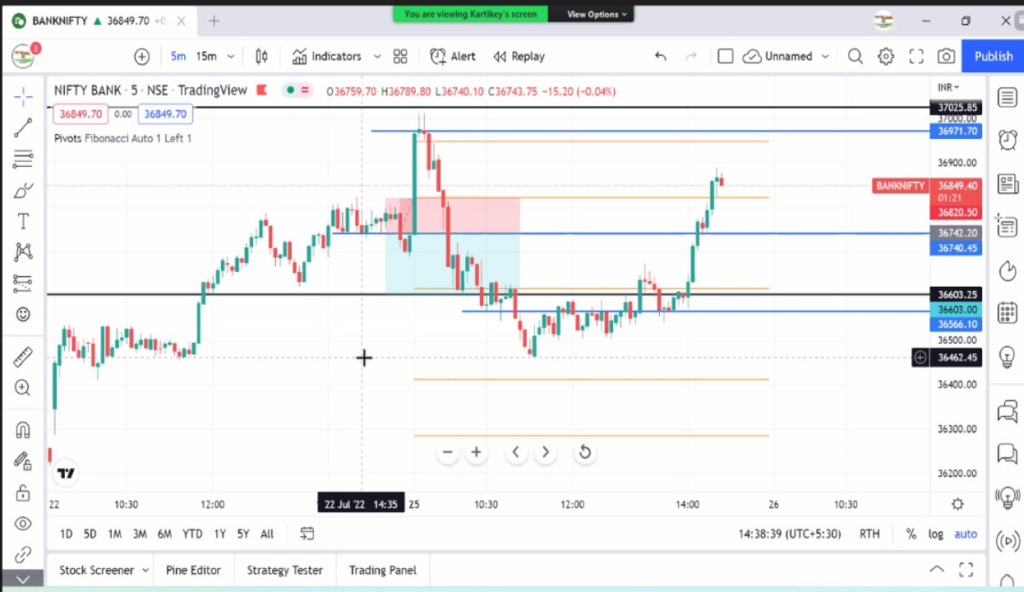

Have a peek into our FREE training sessions

Stockbhart free live sessions are a treasure trove of financial knowledge waiting for you to explore! Picture this: a virtual classroom buzzing with insights, led by seasoned experts in finance. These sessions are like a backstage pass to the world of financial wisdom, and the best part? It won't cost you a dime!

Results who opted our FREE courses

Success Stories From Our Students

"I can't thank Web Wealth enough for the invaluable insights I gained from their stock courses. The course materials are up-to-date and cover a wide range of topics, from fundamental analysis to technical indicators. What sets this course apart is the emphasis on practical application, with real-world examples and case studies that make complex concepts easy to understand. Since completing the course, I've been able to make more informed investment decisions and have seen a noticeable improvement in my portfolio performance."

Amit Sharma

"Web Wealth stock courses exceeded all my expectations! The instructors are not only experts in their field but also excellent educators who genuinely care about their students' success. The course content is comprehensive yet accessible, catering to both beginners and experienced investors. The interactive nature of the courses, with live trading sessions and Q&A sessions, made the learning experience engaging and enjoyable. Thanks to Web Wealth, I now feel confident navigating the stock market and managing my investments effectively."

Nisha Gupta

"I've been dabbling in the stock market for a while, but it wasn't until I enrolled in Web Wealth stock courses that I truly started to see significant results. The courses are well-designed, with a perfect balance of theory and practice. The instructors provide actionable insights and practical tips that have helped me refine my investment strategy and maximize returns. Whether you're a novice or a seasoned investor, I highly recommend Web Wealth stock courses for anyone looking to take their investment journey to the next level."

Anil Patel

"As an aspiring investor, opting for Web Wealth stock courses was one of the best decisions I made. The comprehensive curriculum helped me understand the nuances of the stock market and equipped me with practical strategies to make informed investment decisions. Thanks to the course, I've been able to build a diversified portfolio and have seen significant growth in my investments. Highly recommended!"

Rajesh Kumar

"Enrolling in Web Wealth stock courses has truly been a game-changer for me. The course content is well-structured and easy to grasp, even for someone like me with limited prior knowledge of the stock market. The instructors are incredibly knowledgeable and supportive, and the hands-on approach to learning has helped me gain confidence in managing my investments. I've already started seeing positive results, and I'm excited about the future prospects!"

Priya Patel

Investment Options

Stocks

IPO

Intraday Trading

F&0

Mutual Funds

Debt Market/Bonds

US Stocks

ETF

Commodities

Open an account with

FAQs

The stock market is a marketplace where stocks (shares of ownership in companies) are bought and sold. It’s a way for companies to raise capital and for investors to potentially earn returns on their investments.

Stocks represent ownership in a company. When you buy a stock, you’re buying a small piece of that company. Stocks can increase or decrease in value based on the company’s performance and other factors.

To start investing, you’ll need to:

- Educate Yourself: Learn about stock market basics and investing strategies.

- Open a Brokerage Account: Choose a brokerage firm and open an account to start buying and selling stocks.

- Deposit Funds: Transfer money into your brokerage account.

- Research Stocks: Use tools and resources to research and select stocks.

- Place Orders: Buy stocks through your brokerage account.

- Common Stocks: Offer voting rights and dividends, though dividends are not guaranteed.

- Preferred Stocks: Generally provide fixed dividends and have a higher claim on assets than common stocks, but usually do not come with voting rights.

A stock exchange is a regulated marketplace where stocks and other securities are bought and sold. Examples include the New York Stock Exchange (NYSE) and NASDAQ

A stockbroker is a licensed professional who buys and sells stocks on behalf of clients. You can use a traditional broker, an online brokerage, or a robo-advisor.

Diversification involves spreading your investments across different types of assets or stocks to reduce risk. It’s important because it can help mitigate losses if one investment performs poorly.

Dividends are payments made by a company to its shareholders, typically from its profits. Not all stocks pay dividends, but they can provide a steady income stream.

A stock market index measures the performance of a specific group of stocks. Examples include the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite. Indices provide a snapshot of market trends.

- Buy and Hold: Investing in stocks and holding them for a long period.

- Value Investing: Looking for undervalued stocks based on fundamental analysis.

- Growth Investing: Investing in companies expected to grow at an above-average rate.

- Dividend Investing: Focusing on stocks that pay high dividends for regular income.

- Market Risk: The risk of stock prices declining due to overall market conditions.

- Company Risk: The risk of a company’s performance impacting its stock price.

- Liquidity Risk: The risk of not being able to sell stocks quickly at a fair price.

- Books and Courses: Many books and online courses are available for beginners.

- Financial News: Stay updated with financial news and market trends.

- Practice Accounts: Use virtual trading platforms to practice without risking real money.